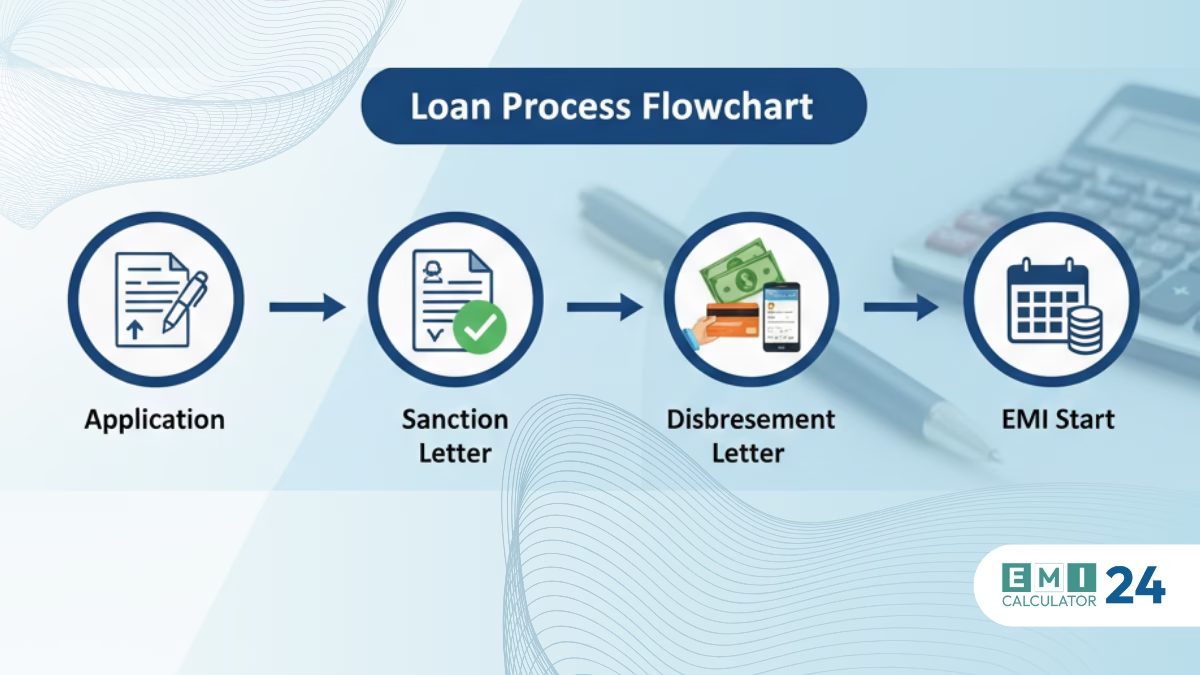

When you apply for a loan, banks and financial institutions follow a step-by-step process 🧭. Two documents play a very important role in this journey—sanction letters and disbursement letters.

Understanding the Loan Sanction Letter vs Disbursement Letter helps you avoid confusion ❌, delays ⏳, and incorrect EMI planning 📉.

Role of Sanction and Disbursement in the Loan Process 🔄

Many borrowers think that loan approval means money is immediately available 💸—but that is not true. The loan process moves through different stages, and each stage has a clear purpose.

Knowing how sanction and disbursement letters work helps you plan expenses, property purchases 🏠, or business needs 📊 more confidently 💡.

| CHECK LOAN ELIGIBILITY |

What is a Loan Sanction Letter? 📨

Loan Sanction Meaning

A loan sanction letter is an official confirmation from a bank or NBFC 🏦 stating that your loan application has been approved after evaluating your income 💼, credit score 📈, and submitted documents 📑.

It confirms eligibility for the loan, but it does not mean the money is released yet ❌💰.

When Is a Sanction Letter Issued?

The sanction letter is issued after document verification ✅ but before any money is transferred ❌💰. It confirms eligibility, not fund release.

What Details Are Mentioned in a Sanction Letter? 📝

-

Approved loan amount 💵

-

Interest rate and type (fixed or floating) 📊

-

Tentative EMI amount 📆

-

Loan tenure ⏱️

-

Conditions to be fulfilled before disbursement ⚠️

Validity Period of a Sanction Letter ⏳

Most sanction letters are valid for 30–90 days. If conditions are not met in this period, the approval may expire ❗.

| CALCULATE EMI |

What is a Loan Disbursement Letter? 💸

Loan Disbursement Meaning

A loan disbursement letter is issued when the lender releases the loan amount 💰 to your bank account, seller, or builder 🏗️.

This is the final confirmation that the money is now available for use.

When Is a Disbursement Letter Issued?

It is issued after all conditions in the sanction letter are met, such as:

-

Signing agreements ✍️

-

Completing insurance formalities 🛡️

-

Property or collateral verification 🔍

What Information Is Included in a Disbursement Letter? 📄

-

Actual amount disbursed 💵

-

Date of disbursement 📅

-

EMI start date 🧮

-

Bank or transaction reference number 🔢

| CALCULATE EMI |

Key Differences Between Sanction & Disbursement Letters 🔍

Understanding Loan Sanction Letter vs Disbursement Letter becomes much easier when you compare them side by side 👇👇

Comparison Table 📊

| Basis | Sanction Letter | Disbursement Letter |

|---|---|---|

| Purpose | Confirms loan approval ✅ | Confirms fund release 💸 |

| Money Transfer | ❌ No | ✅ Yes |

| EMI Start | ❌ No | ✅ Yes |

| Legal Status | Conditional approval ⚠️ | Final confirmation 🔒 |

Why Can Disbursement Be Delayed After Loan Sanction? ⏱️

Even after approval, delays between Loan Sanction Letter vs Disbursement Letter can occur due to:

-

Incomplete or incorrect documents 📂

-

Property legal or technical verification 🏠🔍

-

Pending agreements or signatures ✍️

-

Insurance-related formalities 🛡️

Real-life example 🧠:

A home loan is sanctioned, but the builder’s NOC is pending. The bank cannot disburse funds until it’s cleared.

Can a Loan Be Rejected After the Sanction Letter? ⚠️

Yes. Understanding Loan Sanction Letter vs Disbursement Letter is crucial.

If the borrower fails to meet conditions or provides incorrect information ❌, the lender can cancel the loan before disbursement.

How EMI Calculation Is Linked to Sanction and Disbursement 🧮

EMI calculators show estimates based on sanction terms, but the actual EMI starts only after disbursement 💰.

In Loan Sanction Letter vs Disbursement Letter, the EMI start date depends on the disbursement date, not the approval date 📅.

Mini Example:

-

Loan amount sanctioned: ₹5,00,000

-

Interest rate: 10% p.a.

-

Tenure: 5 years

-

EMI starts after disbursement: ₹10,624/month

This shows why knowing the exact disbursement date is essential for budgeting.

Difference in Home Loan, Personal Loan, and Car Loan 🚗🏠

The time gap between Loan Sanction Letter vs Disbursement Letter varies by loan type:

-

Home loans 🏠: Longest gap due to legal checks and construction stages

-

Personal loans 💼: Shortest gap, often same-day disbursement

-

Car loans 🚗: Moderate gap, as dealer invoice and registration are required

Important Points Borrowers Should Remember 📌

To avoid mistakes related to Loan Sanction Letter vs Disbursement Letter:

-

Never assume funds are available after approval ❌

-

Always check the sanction letter validity 📅

-

Confirm the EMI start date clearly 🧾

-

Use EMI calculators accurately—after disbursement ✅

Frequently Asked Questions (FAQs) ❓

Q1: Is a loan sanction letter and disbursement letter the same?:

A1: No ❌. A sanction letter confirms approval, while a disbursement letter confirms fund release.

Q2: Does EMI start after the sanction letter?

A2: No ❌. EMI starts only after the loan amount is disbursed.

Q3: Can loan disbursement happen in parts?

A3: Yes ✅, especially in home loans and business loans.

Q4: Is disbursement guaranteed after sanction?

A4: Only if all terms and conditions are fulfilled correctly 🔒.

Conclusion: Why Understanding Sanction and Disbursement Is Important 🎯

Understanding Loan Sanction Letter vs Disbursement Letter helps borrowers plan finances better 📊, avoid EMI-related confusion ❌, and make informed loan decisions 🧠.

For EMI calculator users, knowing the exact disbursement date is essential for accurate budgeting and stress-free loan management ✅😊.