Buying a home is one of life’s most exciting milestones 🏡, but it also requires careful planning and smart financial decisions 📝. One key factor that many first-time buyers often overlook is understanding the roles of Applicant and Co Applicant in home loans.

Knowing who is responsible for repayment, how eligibility is calculated, and what rights each person holds can make a big difference in securing the right loan ❓.

This guide explains everything about Applicant and Co Applicant in a home loan in simple, easy-to-understand language.

What is an Applicant and Co Applicant in Home Loan 🧑💼👨💼

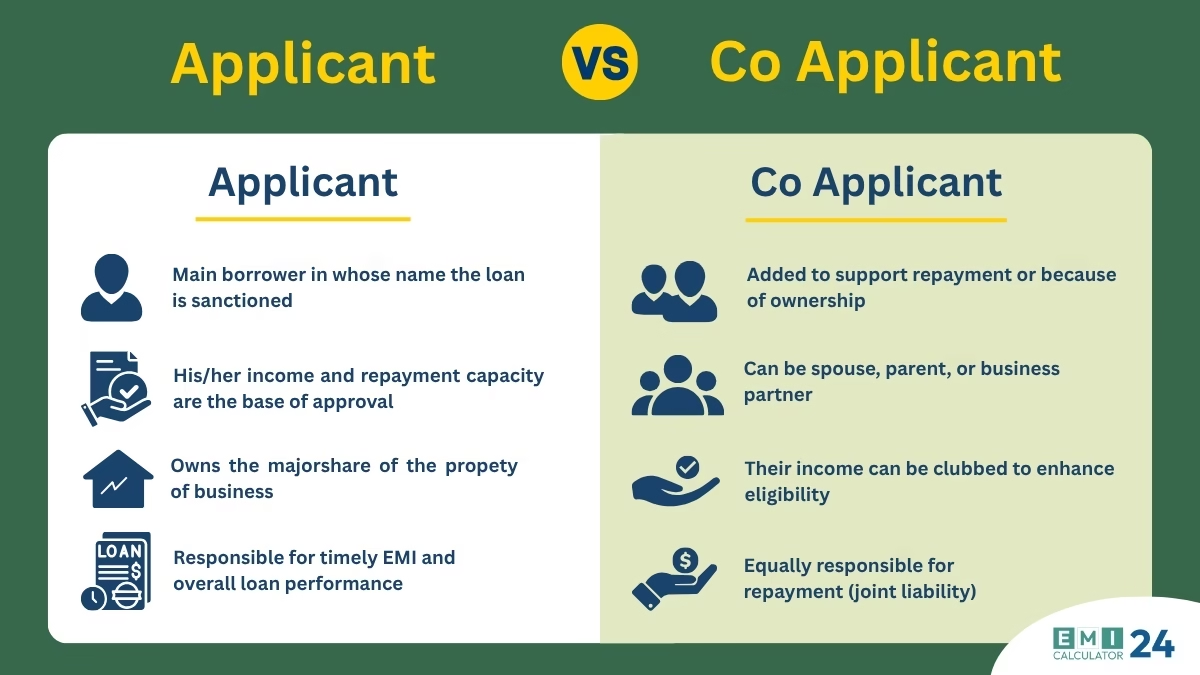

In simple terms, the Applicant and Co Applicant in a home loan have distinct roles:

-

✅ Applicant: The primary person applying for the loan; holds main responsibility for repayment 💳.

-

✅ Co-Applicant: A secondary person who joins the loan to increase eligibility or share repayment 🤝.

Together, the applicant and co applicant in home loan determine the bank’s approval ✅, loan amount 💵, and eligibility 🏦.

Read more about: Common Home Loan Mistakes First-Time Buyers Should Avoid

Difference Between Applicant and Co Applicant (Quick Comparison Table) ⚖️

| Feature | Applicant | Co-Applicant |

|---|---|---|

| Responsibility | Primary loan repayment 💳 | Shares repayment responsibility 🤝 |

| Eligibility | Based on applicant’s income 💰 | Adds co-applicant income to eligibility 📈 |

| Documentation | Complete documents needed 📄 | Partial documents required 🗂️ |

| Rights | Controls loan decisions 📝 | Rights depend on bank rules ⚖️ |

| Example | Mr. A applies alone 👤 | Mr. A’s spouse joins as co-applicant 👥 |

Advantages of Adding a Co-Applicant ✅

-

✅ Higher Loan Eligibility: Combined income can increase approved loan amount 💸.

-

✅ Better Approval Chances: Banks trust loans with more than one responsible person 🏦.

-

✅ Shared Responsibility: Loan repayment burden can be divided 🤝.

Many borrowers find that having an Applicant and Co Applicant in a home loan with SBI or HDFC increases eligibility and approval chances.

Banks trust loans with more than one responsible person 🏦

-

Higher Loan Eligibility: Combined income can increase approved loan amount 💸.

-

Better Approval Chances: Banks trust loans with more than one responsible person 🏦.

| Check your loan eligibility now | Use our EMI calculator |

How a Co-Applicant Increases Loan Eligibility 🧑💼👩💼

Imagine this situation:

Amit earns ₹55,000 per month, and wants to take a home loan. Based on his income, the bank is ready to offer him a loan of around ₹28–30 lakhs.

But Amit adds his wife Neha as a co-applicant, who earns ₹45,000 per month, making her the Co Applicant alongside him in the home loan.

Now their combined income becomes ₹1,00,000, and the bank recalculates their home loan eligibility.

👉 Result:

With a co-applicant, their approved loan amount increases to ₹42–45 lakhs, which allows them to buy a better house in their preferred location

Disadvantages of Having a Co-Applicant ⚠️

-

⚠️ Shared Risk: In case of default by the main borrower, the co-applicant is held responsible ❌

-

❌ Credit Score Impact: Delays affect both parties’ credit ratings 📉.

-

❌ Extra Documentation: Banks require additional paperwork 📄.

Rights of Co-Applicant in Home Loan 🏦

-

✅ Can access loan account statements 📑 as part of the Applicant and Co Applicant agreement in the home loan.

-

✅ Eligible for tax benefits under Section 80C if paying EMIs 💰.

-

✅ Participates in loan decisions in banks like SBI and HDFC 🏦.

Co-Applicant Requirements 📋

-

✅ Preferable family members: spouse, parents, or siblings 👪.

-

✅ Documents: ID proof, income proof, address proof 🗂️.

-

✅ Bank-specific policies: SBI home loan co applicant eligibility and Applicant and co applicant in home loan HDFC rules exist 🏦.

Tip: Co-applicant is not mandatory ❌ but increases loan eligibility ✅.

How to Choose a Co-Applicant 🧐

-

✅ Ensure stable income 💰.

-

✅ Check good credit score 📊.

-

✅ Prefer family members for easier paperwork 👪.

-

✅ Understand shared repayment liability 🤝.

⭐ Co-Applicant vs. Co-Signer — What’s the Difference? (Simple & Practical Guide)

Many home loan applicants get confused between a co-applicant and a co-signer, but both play very different roles in the lending process. Understanding this difference is important for choosing the right structure for your home loan and improving your approval chances.

Meaning & Responsibility Difference 🧑💼⚖️

Meaning & Responsibility Difference 🧑💼⚖️

- ✅ A co-applicant is someone who joins the primary borrower in applying for the home loan. Their income may be considered, their eligibility is evaluated, and their name appears in loan documents.

This helps the bank assess repayment capacity based on combined income. - ✅ A co-signer, on the other hand, does not contribute income or eligibility. They only assure the bank that the loan will be repaid if the borrower defaults. They step in only in case of repayment failure.

👉 This distinction helps clarify the primary borrower meaning, because the primary borrower holds the main responsibility for repayment, while the co-signer is more of a backup guarantor.

Impact on Loan Eligibility & Approval 🔍📈

Impact on Loan Eligibility & Approval 🔍📈

A co-applicant and a co-signer affect loan eligibility in different ways. Here’s the simple breakdown:

Co-Applicant Impact

- Their income is added with the primary borrower’s income.

- Helps to get a higher loan amount.

Evaluated for:

- Income stability

- Credit history

- Financial discipline

Considered under joint home loan rules, where banks combine incomes for better eligibility.

Co-Signer Impact

- Their income is not combined with the borrower’s.

- They help mainly by giving financial assurance to the bank.

- They do not increase the loan amount.

Why This Matters

Choosing the right role affects:

- Total loan amount

- Approval chances

- Interest rate

Banks rely on home loan approval factors like credit score, repayment capacity, income stability, and borrower reliability.

Property Ownership Requirements 🏠📜

Property Ownership Requirements 🏠📜

Understanding ownership rules helps avoid legal and loan-related confusion.

Co-Applicant Requirements

- Usually required to be a co-owner of the property.

- Most banks—including SBI, HDFC, and ICICI—prefer co-applicants who have a share in the property.

- Helps banks ensure financial and legal clarity.

Co-Signer Requirements

- No property ownership is needed.

- They simply guarantee repayment if the primary borrower defaults.

Who Can Be a Co-Applicant?

Typically immediate family members such as:

- Spouse

- Parents

- Siblings (in some cases)

Must be financially capable and legally eligible to support the loan.

Credit Score & CIBIL Impact 📊📉

Credit Score & CIBIL Impact 📊📉

Both co-applicants and co-signers must have strong credit profiles.

Co-Applicant Credit Requirements

The CIBIL score requirement is important because:

- Their income is added for eligibility.

- They share repayment responsibility.

A poor score can reduce loan amount or increase interest rate.

Co-Signer Credit Requirements

- Must also maintain a good credit score.

- They are legally responsible if the borrower defaults.

Shared Impact

Any repayment delay or default affects:

- Co-applicant’s credit

- Primary borrower’s credit

- Co-signer’s credit

Everyone involved shares credit risk.

When Should You Choose a Co-Applicant vs. Co-Signer? 🎯

When Should You Choose a Co-Applicant vs. Co-Signer? 🎯

Choosing the right role depends on your loan needs and family plan.

Choose a Co-Applicant If:

- You want a higher loan amount.

- You are buying the property jointly with a family member.

- You want to share EMI responsibility.

- You want stronger approval chances through combined income.

Choose a Co-Signer If:

- You do not need extra loan eligibility.

- You need only a guarantee for repayment.

- The property will be owned solely by the primary borrower.

- The other person does not want ownership responsibility.

Applicant and Co Applicant in Home Loan in Hindi

अगर आप हिंदी में समझना चाहते हैं:

-

✅ Applicant: मुख्य लोन लेने वाला व्यक्ति 🧑💼

-

✅ Co-Applicant: सह-आवेदक जो लोन में शामिल होता है 👨💼

-

✅ सह-आवेदक की आय बैंक के लिए लोन तय करने में मदद करती है 💵

FAQs ❓

Q1. Who is considered the main borrower in a home loan? 🧑💼🏡

Answer: The main borrower is the person who takes primary responsibility for the home loan repayment 💳. They handle documentation, repayment tracking, and communication with the bank throughout the loan tenure 📝🏦.

Q2. How do Applicant and Co Applicant roles impact home loan eligibility? 📈🤝

Answer: The income of both the Applicant and Co Applicant is combined by the bank to determine a higher loan eligibility amount 💰. This joint evaluation often helps applicants qualify for bigger loan amounts and smoother approvals 🏦✨.

Q3. Is a co-applicant mandatory for all home loans? ❓🏠

Answer: No, a co-applicant is not mandatory ❌. However, adding one—especially a spouse or parent—can strengthen the loan profile 💼, increase eligibility 📊, and provide better repayment assurance to the bank 🤝.

Q4. Does a co-applicant need to be a co-owner of the property? 🏡📜

Answer: In most cases, yes ✔️. Many banks prefer the co-applicant to also be a co-owner of the property 🏠, especially in home loans taken with a spouse 👩❤️👨. This ensures legal and financial clarity for both the lender and borrowers ⚖️.

Q5. Can the credit score of a co-applicant affect the loan approval? 📉📊

Answer: Yes, the credit score of both the applicant and co-applicant is evaluated ✔️. A strong score improves approval chances 🚀, while a weak score may reduce eligibility or increase interest rates 📉💳.

Conclusion 🏁

Understanding the applicant and co applicant in home loan is crucial for anyone planning to buy a home 🏡. The applicant holds the main responsibility 💳, while a co-applicant can boost loan eligibility 📈, share repayment 🤝, and improve approval chances 🏦. However, having a co-applicant also comes with responsibilities ⚠️ like shared liability and credit score impact 📉.

By carefully choosing a reliable co-applicant and knowing your rights and duties 📝, you can make smarter, safer home loan decisions ✅. Always check bank-specific rules like SBI home loan co applicant eligibility or HDFC co-applicant guidelines before applying.

Remember, a co-applicant is not mandatory ❌, but can be a valuable addition for higher loan amounts 💰 and smoother approval ✅. Make informed decisions today for a secure home tomorrow 🏠💖.

Featured Summary Box 📌

| Topic | Key Point |

|---|---|

| Applicant | Primary borrower, responsible for repayment 💳 |

| Co-Applicant | Secondary borrower, shares repayment 🤝, increases eligibility 📈 |

| Advantages | Higher loan 💰, better approval 🏦, shared burden 🤝 |

| Disadvantages | Shared liability ⚠️, credit impact 📉, extra paperwork 🗂️ |

| Documents | ID, income, address proofs required 📝 |

| Bank Example | SBI, HDFC co-applicant rules 🏦 |

Meaning & Responsibility Difference 🧑💼⚖️

Meaning & Responsibility Difference 🧑💼⚖️