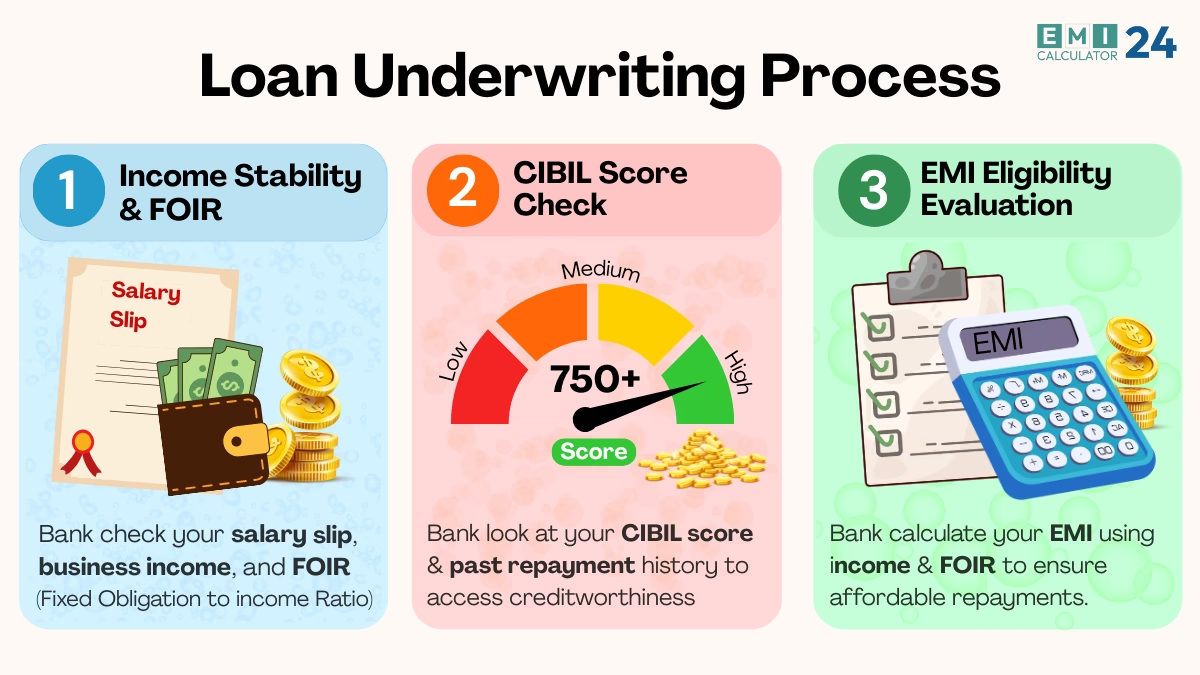

Loan Underwriting Process Explained: How EMI, CIBIL Score, and Income Affect Bank Loan Approval

The Loan Underwriting Process is a critical step in bank loan approval. Understanding how banks assess your income, CIBIL score, and EMI eligibility can significantly improve your chances of getting a loan approved. 💰🏦 In this guide, we explain everything step by step, with practical examples for salaried and self-employed borrowers. 💰📊 Calculate Your EMI … Read more